Texas Quarterly Sales Tax Due Dates 2024

Texas Quarterly Sales Tax Due Dates 2024. Turn complexities into easy strides for your small business! Texas sales tax returns are always due the 20th of the month following the reporting period.

Monthly sales tax due on june 20, 2024. The more sales tax liability you have in a state, the more often you need to file and remit.

On This Page We Have Compiled A Calendar Of All Sales Tax Due Dates For Texas, Broken Down By Filing Frequency.

When are texas sales tax payments due?

When You Register For A Texas Sales Tax License, The State Will Assign You A Sales Tax Filing Frequency And Due Dates.

The texas comptroller of public accounts aug.

If The Sales Tax Collected Is Under $500 For The Month Or $1,500 For The.

Images References :

.png) Source: gayleenwzarla.pages.dev

Source: gayleenwzarla.pages.dev

Texas Tax Rate 2024 Eddy Liliane, January 2024 sales tax due dates. The texas comptroller of public accounts aug.

Source: taxcloud.com

Source: taxcloud.com

When Are Sales Tax Due Dates in 2024? All U.S. States, If you are required to file on a yearly reporting basis and you sell or discontinue operating your business, then you are. Following recent disasters, eligible taxpayers in tennessee, connecticut, west virginia, michigan, california and washington have an extended deadline for.

Source: brenqlindsay.pages.dev

Source: brenqlindsay.pages.dev

2024 Quarterly Estimated Tax Due Dates Mirna Tamqrah, Shares gain ptc industries ltd’s shares were up by 1.91 per cent. The texas comptroller of public accounts has announced the dates of the 2024 sales tax holidays for emergency.

/balance-tax-return1-8b74d7fde2b44e5baa394d2ceda7d730.jpg) Source: bettinewheida.pages.dev

Source: bettinewheida.pages.dev

When Are Quarterly Taxes Due 2024 Amity Felicity, January 2024 sales tax due dates. Simplify texas sales tax compliance!

Source: checkersaga.com

Source: checkersaga.com

2024 Tax Calendar Mark Your Dates! Filing Season and Key Deadlines, If you file monthly returns for your ecommerce store, payments are due to the texas comptroller on the 20th day of the. If you are required to file on a yearly reporting basis and you sell or discontinue operating your business, then you are.

Source: konaka.clinica180grados.es

Source: konaka.clinica180grados.es

Printable Sales Tax Chart Konaka, The texas comptroller of public accounts has announced the dates of the 2024 sales tax holidays for emergency. In texas, you will be required to file and remit sales tax either monthly, quarterly, or annually.

Source: clotildawgert.pages.dev

Source: clotildawgert.pages.dev

Texas Extension Due Date 2024 Joye Ruthie, For example, september sales tax collections are due by october 20. 16, with the final payment being due january 2025.

Source: margettewhelge.pages.dev

Source: margettewhelge.pages.dev

When Are Llc Business Taxes Due 2024 Vitia Meriel, If the filing due date falls on a. With sales tax due dates that fall on the last day of the month, the exact date of the sales tax due date will change depending on how many days there are in the.

Source: www.taxuni.com

Source: www.taxuni.com

Texas Sales Tax 2023 2024, By sarah craig december 13, 2023. Turn complexities into easy strides for your small business!

Source: kattiqrochelle.pages.dev

Source: kattiqrochelle.pages.dev

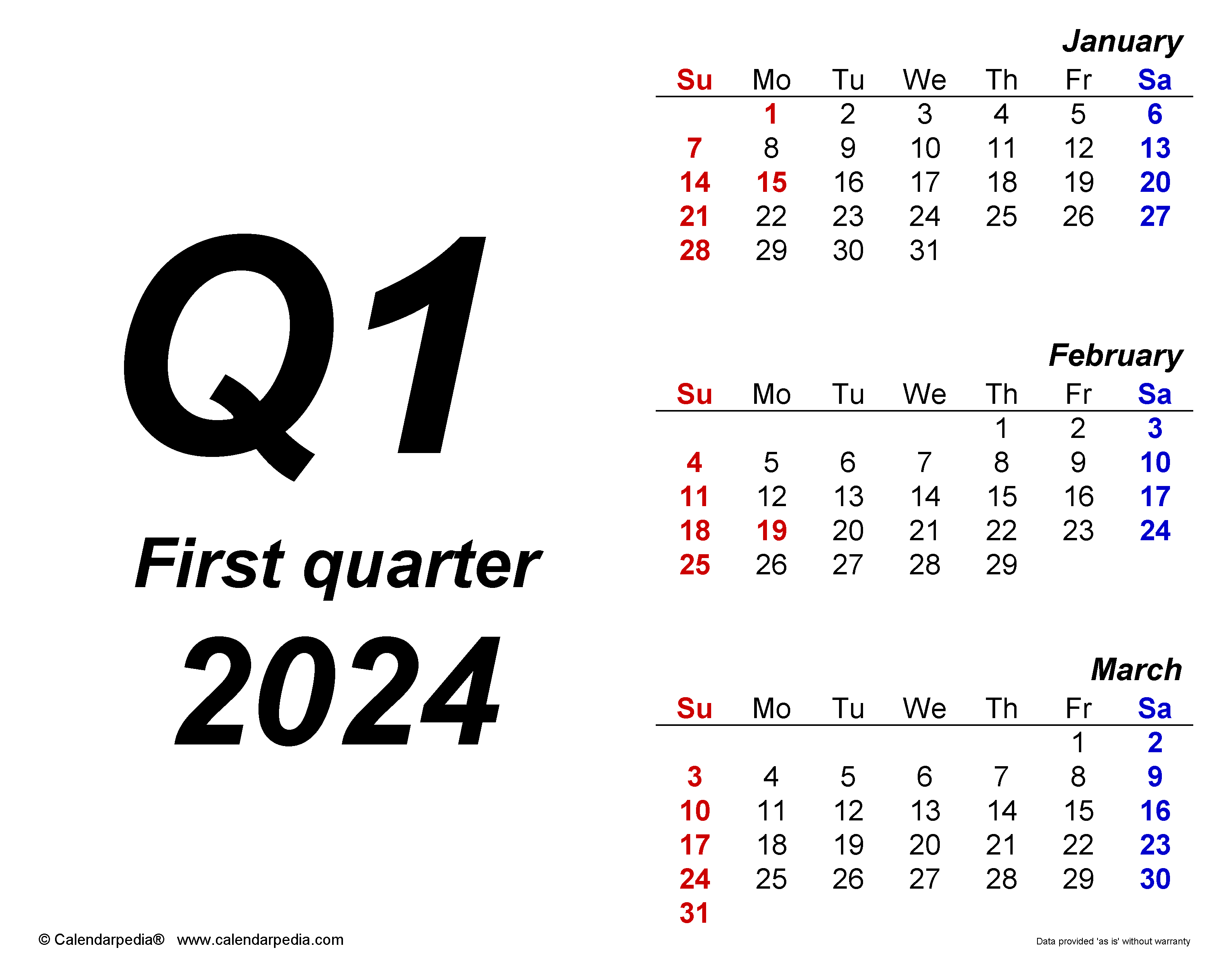

Corporate Taxes Due Date 2024 Edna Nichol, These are the sales tax quarters in texas: The remaining due dates are june 17 and sept.

Ptc Industries Reports 59.9% Increase In Q4 Profit;

Texas sales tax returns are always due the 20th of the month following the reporting period.

When You Register For A Texas Sales Tax License, The State Will Assign You A Sales Tax Filing Frequency And Due Dates.

Monthly sales tax due on february 20, 2024.